Mr. Sebright Chen Delivers Insightful Discussion at Life Science Nation’s Investor Fireside Chat

- Summer Atlantic

- Nov 24, 2024

- 2 min read

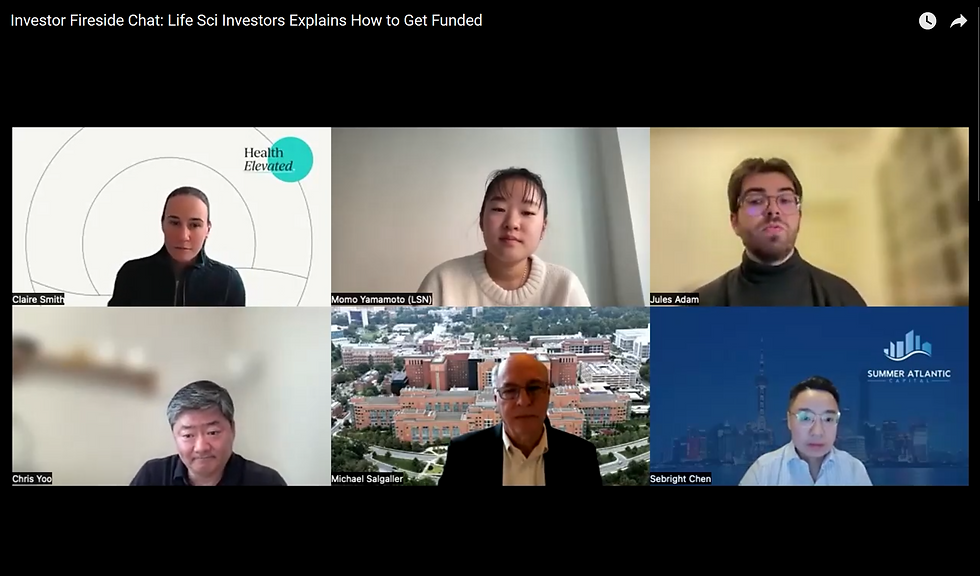

On November 19, 2024, Mr. Sebright Chen, Founder, Chairman, and CEO of Summer Atlantic Capital, joined esteemed industry leaders in Life Science Nation’s Investor Fireside Chat. The discussion, moderated by Jules Adam of Labiotech, provided a platform for exploring investment strategies, red flags in due diligence, and transformative trends shaping the life sciences and healthcare sectors.

Key Highlights of Mr. Chen’s Discussion

Investment Focus Areas

Mr. Chen emphasized Summer Atlantic Capital's commitment to fostering innovation in life sciences and healthcare, focusing on:

Biotech Assets: Clinical-stage assets addressing critical health challenges.

Medical Devices: Both clinical and commercialization-stage innovations.

HealthTech and Digital Health: Revenue-generating, software-based healthcare solutions.

2024 Sector Performance and Trends

Mr. Chen highlighted 2024 as a transformative year marked by advancements in precision medicine, digital health, and medical devices. Key observations included:

Digital Health Dominance: Rapid adoption of software-based healthcare tools, emphasizing precision, efficiency, and accessibility.

Medical Device Innovations: Enhanced focus on chronic disease management and smarter, software-integrated devices.

These trends illustrate the sector's ongoing shift toward personalized healthcare, with scalable solutions that deliver both social impact and commercial success.

2025 Investment Predictions

Looking ahead, Mr. Chen outlined three major trends:

Precision Medicine Expansion: Technologies enabling tailored treatment approaches, including genomics and AI-driven solutions, will dominate.

Digital Health Growth: Investors will favor revenue-generating software solutions with seamless integration into traditional healthcare.

Strategic M&A and Partnerships: Increased collaboration, co-investments, and joint ventures to accelerate market access and portfolio diversification.

Due Diligence and Red Flags

Mr. Chen detailed a rigorous approach to due diligence, prioritizing:

Leadership Excellence: Experienced, visionary teams with proven execution capabilities.

Scalable Business Models: Clear pathways to profitability and growth.

Market Understanding: Competitive advantages and compliance with regulatory requirements.

He cautioned against red flags such as unrealistic projections, poor governance, high cash burn without progress, and ethical concerns like non-compliance or questionable capital sources.

Closing Thoughts

Mr. Chen emphasized the critical role of collaboration and transparency in building lasting partnerships. "When we invest, we are not just betting on technology—We are betting on people, processes, and a vision that can weather challenges and create lasting impact," he remarked.

The event concluded with optimism for 2025, highlighting the potential of the life sciences sector to reshape global health outcomes.

About Life Science Nation (LSN)

Life Science Nation (LSN) is a leading global platform connecting early-stage life science companies with investors and strategic partners. Through its dynamic initiatives, including the Redefining Early Stage Investments (RESI) Conference series, LSN fosters innovation by facilitating meaningful connections within the biotech, medtech, digital health, and healthcare industries.

About Labiotech

Labiotech is a leading digital media platform dedicated to the biotechnology industry, providing comprehensive news, analysis, and insights to professionals worldwide. Covering a wide range of topics, including pharmaceutical developments, healthcare innovations, and emerging biotech trends, Labiotech serves as a trusted source for industry updates and thought leadership.

About Summer Atlantic Capital

Summer Atlantic Capital is a premier international asset management hub specializing in life sciences and technology investments. Founded in 2018, the firm focuses on fostering the global expansion of companies from North America and Europe, providing strategic equity and debt investments, as well as joint venture partnerships. The firm's investment strategy emphasizes scalable innovations with societal impact, aligning short-term profitability with long-term sustainability.

.png)

Comments